4 Trends in Trading Blackout Periods

April 10, 2024

While not mandated under law, the use of blackout periods is a nearly universal component of the insider trading compliance programs of most publicly held companies. The SEC requires public companies to create an environment in which employees are discouraged from insider trading; companies that fail to do this can be held liable for any insider trades by their employees. Over time, trading blackout periods have emerged as one concrete way companies can demonstrate that they discourage insider trading.

The Trends

Trading blackouts are arguably a blunt (but effective) instrument. Even so, there are many nuances to consider, including who should be subject to them, which transactions are prohibited, and what periods should the blackouts be in effect for. For today’s blog entry, I discuss four trends in blackout period design from the NASPP/Deloitte Tax 2022 Equity Administration Survey.

Blackout periods are just one component of insider trading compliance. The 2022 survey also reports trends in pre-clearance procedures, Section 16 and Form 144 filings, and other aspects of a well-rounded insider trading compliance program.

Trend 1: Executives

Executives are subject to blackout periods at virtually all public companies.

It probably comes as no surprise to learn that most public companies use quarterly blackout periods to discourage insider trading and that the following groups of individuals are most likely to be subject to these quarterly blackout periods:

- Section 16 executives (subject to quarterly blackout periods at 96% of companies)

- Other senior management (76% of companies)

- Employees with access to financial or material nonpublic information (92% of companies)

Trend 2: Lower Ranking Employees

Lower ranking employees are more likely to be subject to blackout periods at smaller companies.

We see considerably more variation in practice for lower ranking employees. Overall, middle management employees are subject to quarterly blackouts at only 39% of companies, other exempt employees at 32% of companies, and nonexempt employees at 29% of companies.

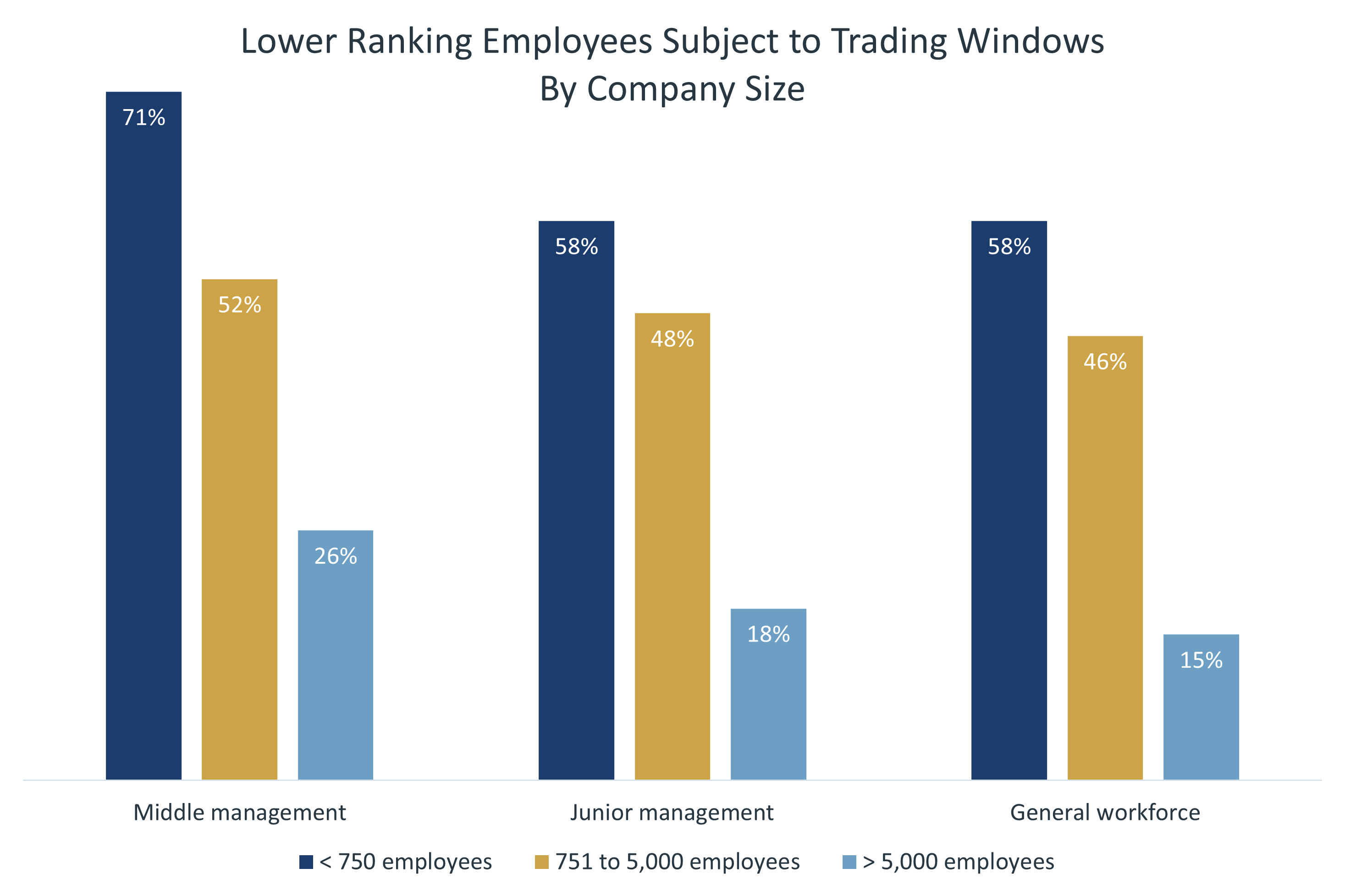

But if we compare practices by company size, we see that the percentage of companies that impose blackout periods at these employee levels increases for smaller companies and decreases for larger companies. The percentage of small companies (less than 750 employees) that impose blackout periods on middle management, other exempt, and nonexempt employees increases to 71%, 58%, and 58%, respectively. On the other hand, for large companies (more than 5,000 employees), these percentages drop to 26%, 18%, and 15%, respectively.

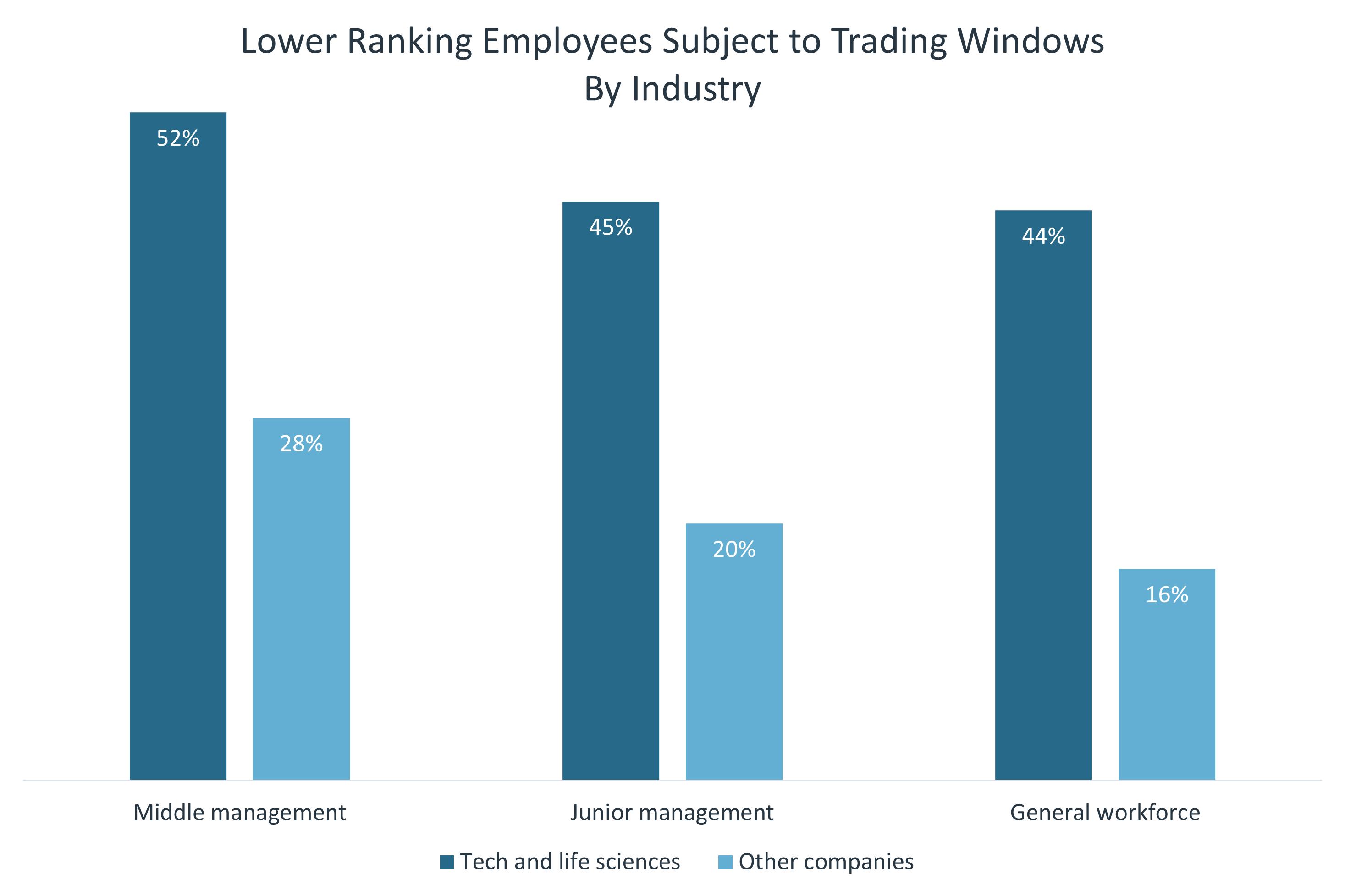

Technology and life sciences companies are also more likely to subject lower ranking employees to trading windows than other types of companies.

Trend 3: Blackout Period Length

Blackout periods are typically two weeks to a month in length.

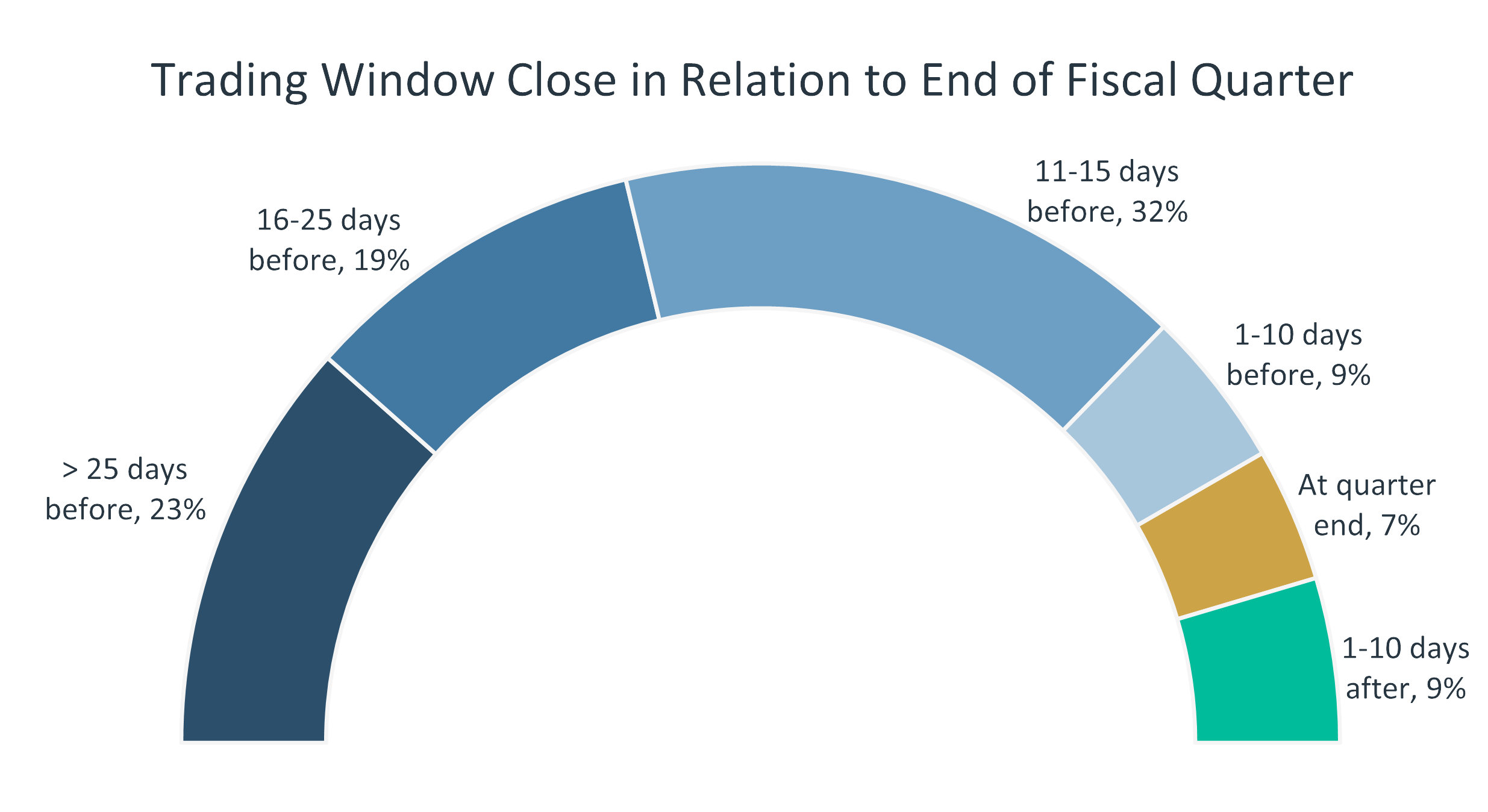

Quarterly blackout periods coincide with the end of fiscal quarters and are lifted shortly after earnings are released. Seventy-five percent of companies close their trading window 11 days or more before the end of their fiscal quarter:

- 32% close their trading window 11 to 15 days before the end of their fiscal quarter.

- 23% close their trading window more than 25 days before the end of their fiscal quarter.

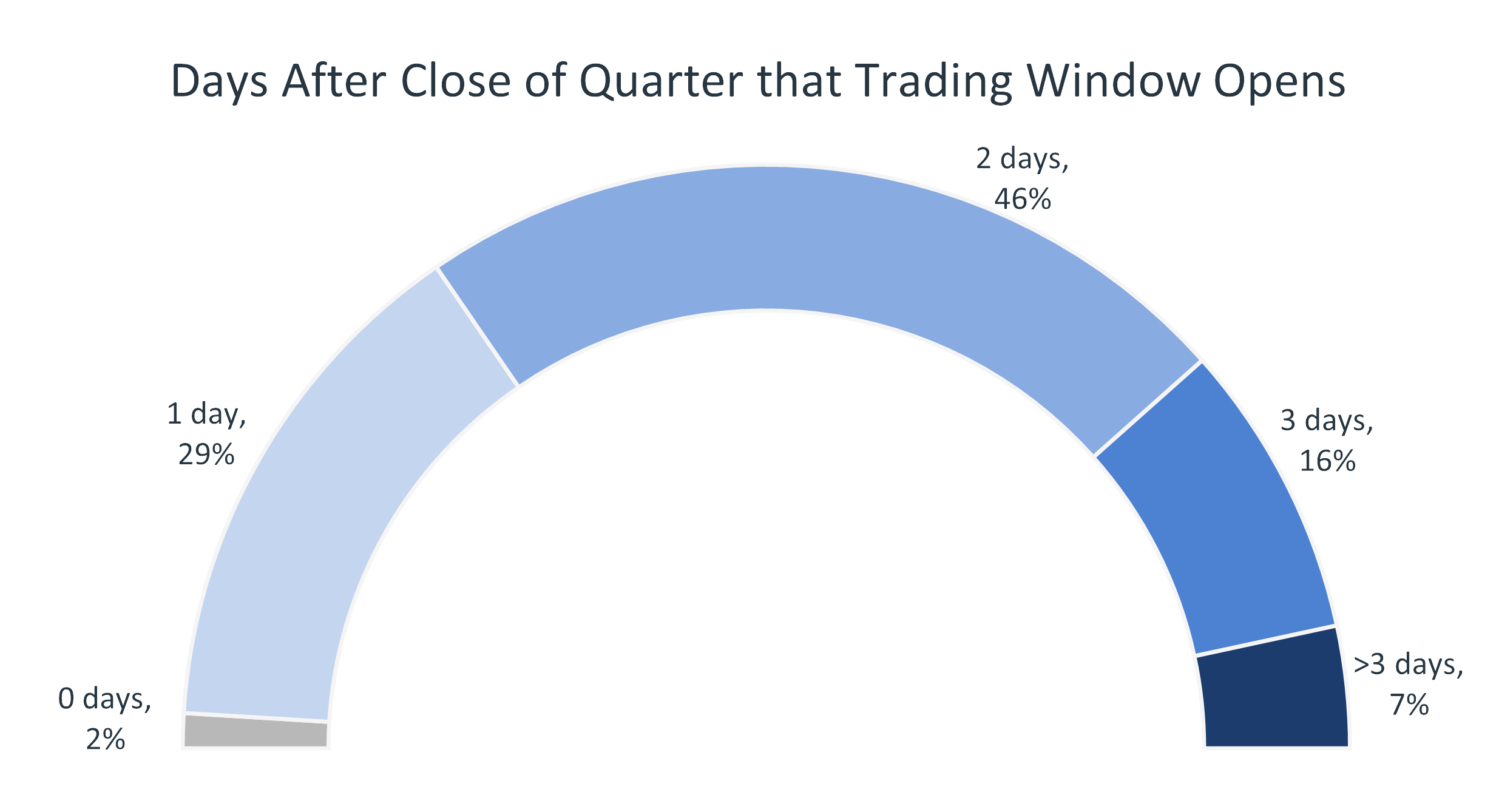

Almost half (46%) of companies allow trading to recommence two trading or calendar days after earnings are announced. Another 29% open the trading window even sooner—one trading or calendar day after earnings are announced.

Trend 4: Prohibited Transactions

Share withholding to cover taxes due on restricted stock and unit awards is typically permitted during blackout periods.

Transactions involving open market sales, such as same-day sale exercises, are typically prohibited during blackout periods, but companies are often less restrictive for transactions that don’t occur on the open market. This makes sense; open market transactions involve the greatest risk of violations of insider trading laws. Below are common nonmarket transactions and the percentage of companies that prohibit each during blackout periods:

- Net stock option exercises, 63% of companies prohibit during blackout periods

- Gifts, 44%

- Cash option exercises, 43%

- Transactions in 401(k) plans, 36%

- Share withholding on restricted stock/unit awards, 35%

- Changes in ESPP contribution rates, 17%

You can see that less than a third of companies prohibit share withholding for restricted stock/unit awards during blackouts.

About half of companies require terminated employees to comply with blackout periods, particularly if they terminate while a trading blackout is in effect.

More Information

For more trends in the administration of equity plans, check out our webinar "Best Practices in Equity Plan Administration." If your company participated in the survey, you also have access to the full results.

Don't Miss Our Current Survey

Our 2024 Equity Incentives Design Survey is now in progress. This survey covers the design of service and performance-based stock option and full value award programs. It will report on the types of equity awards public companies grant, who they grant them to, and terms and conditions the awards are subject to (including vesting, forfeiture, retirement, leave of absence, and other provisions). The survey is open through April 26, 2024, and all companies who participate will receive access to the full results. There is no cost to participate. Register to participate today!

-

By Barbara BaksaExecutive Director

NASPP