5 Trends in Full Value Awards

June 04, 2025

Full value awards, especially restricted stock units, have evolved significantly over the past two decades—and today, they dominate the equity compensation landscape for public companies. The 2024 NASPP/Deloitte Tax Equity Incentives Design Survey reveals several key trends that are reshaping how companies, particularly in the tech and life sciences sectors, are structuring their award programs.

Trend #1: Full Value Awards Dominate as the Equity Vehicle of Choice

RSUs have become the go-to equity vehicle for public companies. As illustrated in the GIF below, virtually all public companies grant service-based full value awards, and 90% offer performance-based awards—dramatic increases from 2000, when only 20% of public companies granted service-based full value awards and only 29% granted performance-based awards.

During the same period, the percentage of public companies that offer stock options has declined from 100% in 2000 to just over 40% in 2024.

Percentage of Companies Granting Various Equity Vehicles

RSUs Are the Most Prevalent Form of Full Value Award

When public companies grant full value awards, they typically do so in the form of RSUs. Among companies that grant service-based full value awards, 95% grant RSUs and only 14% grant restricted stock. This is also a significant shift from 2000, when virtually all 20% of companies that granted service-based full value awards did so in the form of restricted stock.

Why the shift to full value awards?

Several factors have contributed to the reversal in practice:

Accounting Treatment

The adoption of FAS 123(R) (now ASC 718) in 2004, is a significant driver of the shift in practices. Prior to FAS 123(R), companies did not recognize any expense for service-based at-the-money stock options. At the same time, granting stock options enabled companies to increase employee compensation, raise capital, and realize a tax deduction. These benefits created a strong impetus to grant stock options and served as a deterrent to granting any other type of discretionary equity vehicle.

FAS 123(R) equalized the financial effect of all forms of equity compensation for the granting corporation, eliminating any accounting preference for stock options and freeing companies to select the equity vehicle that most aligns with the company’s strategic objectives.

Market Disruptions

Significant market disruptions, including the collapse of the tech bubble in 2001 and the housing crisis of 2008 to 2009, caused many companies to experience dramatic and prolonged declines in their stock prices, resulting in large quantities of steeply underwater stock options, some of which never fully recovered. This soured many companies on stock options.

Shareholder Pressure

Investors and proxy advisors have long criticized stock options for delivering a benefit for overall market increases rather than individual or company performance. This has forced public companies to shift away from service-based stock options towards performance awards.

Trend #2. Lower-Ranking Employees Receive RSUs (If They Receive Equity at All)

Although it is common for public companies to grant a mix of equity awards to senior executives, when lower-ranking employees receive discretionary equity awards, they typically receive only one type of vehicle—RSUs.

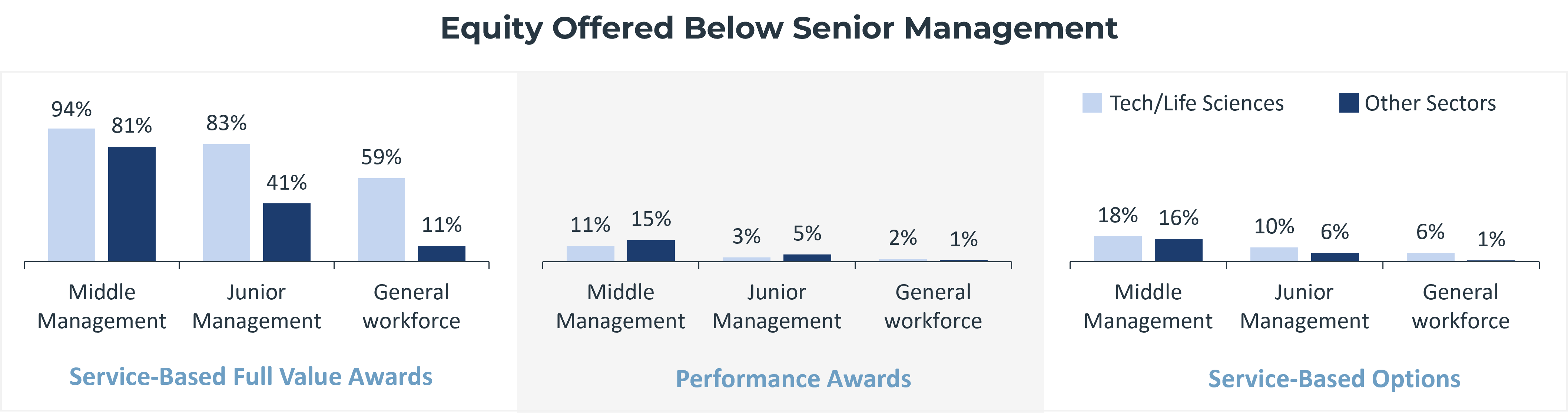

Companies in the tech and life sciences sectors are the most likely to offer full value awards (most commonly RSUs) below senior management, with 94% granting awards to middle management, 84% granting awards to junior management, and nearly 60% granting awards to their general workforce (defined as nonexempt employees in the survey).

This is in stark contrast to other industries, where, although 81% of companies grant full value awards to middle managers, only 41% grant awards to junior managers and only 11% grant awards to their general workforce.

Regardless of industry sector, performance-based awards are still reserved primarily for senior-level employees, with less than 20% of companies extending them more broadly. Ditto for stock options.

Trend #3: Quarterly Vesting Is on the Rise—But Not in All Sectors

A notable trend among tech and life sciences companies is the increasing use of quarterly vesting for full value awards. Between 2021 and 2024, the percentage of companies using quarterly vesting in these sectors rose from 23% to more than 40%. Among tech and life sciences companies, quarterly vesting is now nearly as common as annual vesting for both new-hire and ongoing grants, and is more common than annual vesting for retention awards.

New-hire grants that use quarterly vesting commonly include a one-year cliff, whereas ongoing and retention grants are more likely to immediately commence vesting on a quarterly basis.

However, this trend hasn’t spread evenly—quarterly vesting is rare outside of the tech and life sciences sectors, with less than 10% of companies in other industries using this vesting frequency for full value awards.

Why the shift to quarterly vesting?

There are several reasons that may explain why tech and life sciences companies are shifting to quarterly vesting:

Employee Retention: Quarterly vesting can make equity awards feel more attainable for employees and, as a result, may help with retention.

Larger Grants: Because tech and life science companies tend to rely heavily on equity compensation, their awards may be larger, making more frequent vesting events feasible.

Lower Ranking Grant Recipients: As noted above, these sectors are more likely to grant full value awards to the rank-and-file, where quarterly vesting may be more impactful in terms of employee retention.

Pre-IPO Practices: Start-ups in the tech and life sciences sectors traditionally grant stock options that vest on a monthly basis. Thus, when these companies go public and transition to full value awards, they may favor more frequent vesting intervals in light of their historical practices.

What about full cliff vesting?

Full cliff vesting, in which 100% of the award vests at the end of the vesting period, is not common for full value awards. When used, it is most often for retention awards granted by companies outside of the tech and life sciences sectors: 33% of non-tech/life sciences companies use full cliff vesting for retention awards.

What is the length of the typical vesting period?

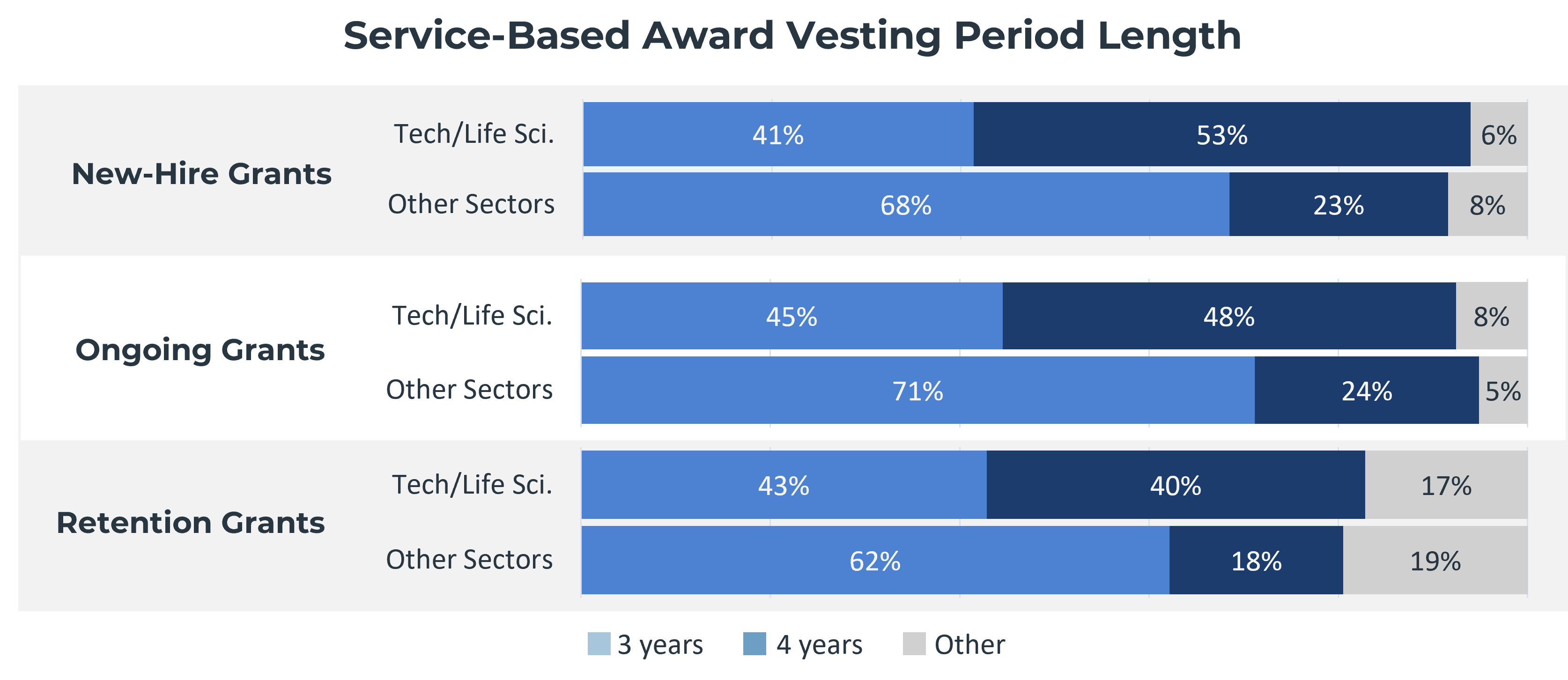

Vesting schedule lengths also differ by sector. As illustrated in the chart below, tech and life sciences companies favor four-year vesting for new hire and ongoing awards, while other industries predominantly stick with three-year schedules.

Trend #4: Companies Don’t Adjust Vesting for Leaves of Absence

Despite increased focus on leave policies in general, most companies overwhelmingly do not adjust vesting of full value awards for leaves of absence. For statutory leaves and paid nonstatutory leaves, over 90% of companies make no adjustment to vesting. If companies do adjust vesting for leaves, they are most likely to do so for unpaid nonstatutory leaves, but even in this scenario, only 17% of companies report that they adjust vesting.

Why so few adjustments? It’s a mix of practical and policy considerations.

Trend #5: Tech and Life Sciences Companies Are Less Generous to Retirees

Companies outside of tech and life sciences are much more likely to provide retirement treatment for full value awards. Among these sectors:

- 81% pay out service-based awards to retirees

- 84% pay out performance-based awards

In contrast, only 35% of tech/life sciences companies pay out service-based full value awards upon retirement, and just 54% pay out performance awards.

When awards are paid out to retirees, the treatment is similar across sectors. Service-based full value awards are slightly more likely to continue vesting rather than accelerate, and performance-based RSUs nearly always continue vesting post-retirement.

Check out our data on retirement practices in the article “Retirement Provisions for RSUs.”

More Info

Check out our webinar highlighting the 2024 Equity Incentives Design Survey results for more trends in equity programs.

-

By Barbara BaksaExecutive Director

NASPP