How to Source Equity Comp Income for Mobile Employees

July 31, 2024

In this Blog, I go back to the basics to discuss sourcing of equity compensation, in particular the difference between using the grant-to-vest and the grant-to-exercise sourcing methodologies. There seems to be a lot of confusion on the appropriate use of these methodologies. For example, it is a common mistake to think that grant-to-exercise is the default sourcing methodology for stock options and grant-to-vest is the default sourcing methodology for RSUs. Before we get into the details, let us review why sourcing is important.

What Is Sourcing and Why Does it Matter?

Simply put, sourcing is the method used to determine the jurisdictional source of income. In general, jurisdictions (countries and/or states) tax

- residents on worldwide income and allow tax credits against tax on outside sourced income.

- nonresidents on sourced income.

Therefore, sourcing can be used to determine taxability.

Of course, this is a generalization, and some jurisdictions determine taxable income using different principles. For example, Singapore does not tax the equity income of residents if the equity was not granted for Singaporean services or during/for Singaporean employment. Some countries may also have special income inclusion and exclusion rules for new residents. However, in general, the treatment described in the above bulleted summary is accurate for most jurisdictions.

Most jurisdictions consider employment income to be sourced where the work is performed. There are some jurisdictions that consider the income to be sourced where the employment is based regardless of where the work is actually performed, e.g., New York.

Particular items of compensation may be sourced based on the reasons why they were awarded (e.g., a bonus for completing a project in a particular location may be fully sourced to that jurisdiction even if the employee worked in that jurisdiction only part of the time).

What Are the Sourcing Methods for Equity Compensation?

For income earned over multiple years, the general view is that the income is earned ratably over time. In this blog we are considering only stock-settled awards; different rules may apply to cash-settled awards.

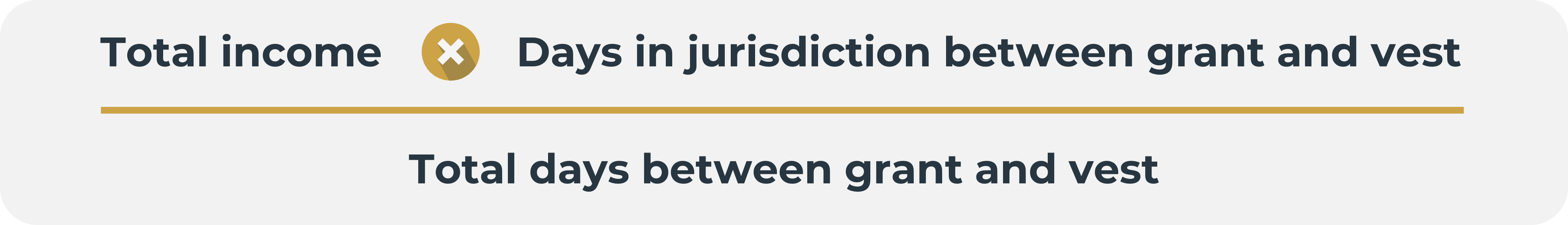

In 2004, the Organization for Economic Cooperation and Development (the OECD) issued a white paper entitled, "Cross-border Income Tax Issues Arising from Employee Stock-Option Plans," in which they recommended that the default sourcing methodology for stock options should be grant-to-vest. That is:

After the release of the white paper, several countries, including the US[1], adopted this methodology. In addition to its federal acceptance, many US states also adopted it separately. This methodology also has been extrapolated to other types of equity awards (e.g., RSUs, SARSs, etc.).

Illustration of the Difference Between the Two Methodologies

Zoey works in Country A. On January 1, 2020, Zoey receives stock options of over 1,000 shares from her employer that vest in four equal annual installments. The fair market value of the shares on January 1, 2020, is $1 per share; this is also Zoey’s exercise price.

Zoey moves to Country B on January 1, 2022, where she becomes a resident and remains employed by the same corporate group. She exercises the stock options in their entirety on January 1, 2025, when the fair market value of the shares is $11 per share.

Grant-to-Exercise Methodology

Under the grant-to-exercise methodology, the income sourced to Country A is $4,000

![Grant to exercise formula: [1,000 shares x ($11 - $1) x 2 years in Country A] divided by 5 years from grant to exercise](/images/default-source/blog-images/2024/july/how-to-source-equity-comp-income-for-mobile-employees.grant-to-exercise.png?sfvrsn=85cc22f4_4)

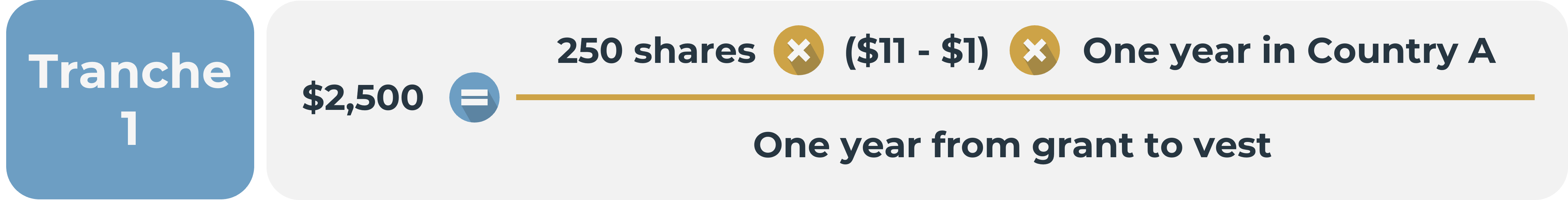

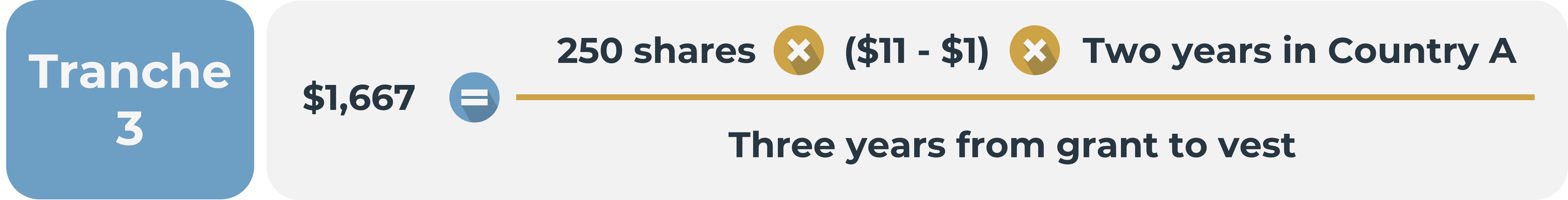

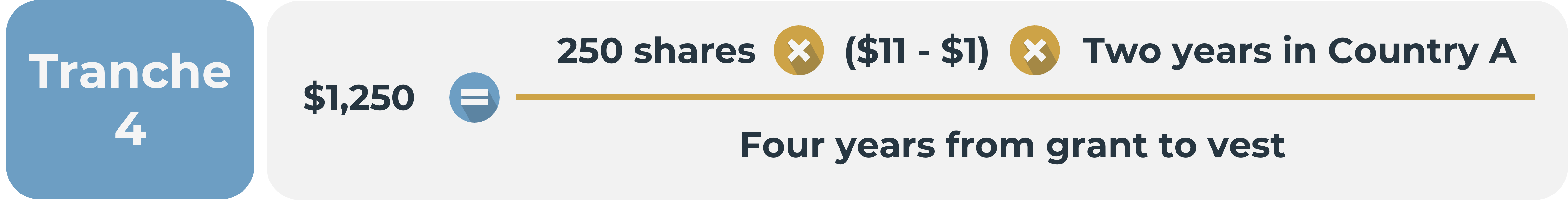

Grant-to-Vest Methodology

Under the grant-to-vest methodology, the income sourced to Country A is $7,917 (rounded to the nearest dollar) and must be calculated separately for each tranche:

Determining the Correct Sourcing Method

In general, determining the correct amounts to report and withhold for mobile employees, requires a three-step process that needs to be repeated for each tax type:

- Determine the tax sourcing regulations of the non-resident jurisdiction (where the employee lived or worked but is no longer resident at the time of the transaction).

- Determine the tax regulations of the resident jurisdiction.

- Review whether any exclusions, exemptions, or deductions exist either in the resident jurisdiction or under a tax treaty or other tax agreement between the resident and non-resident jurisdictions. Some treaties allow for income to be sourced differently than the domestic regulations (e.g., the UK-US tax treaty allows the taxpayer to elect to source stock options using the grant-to-exercise methodology instead of the grant-to-vest methodology even though the latter is the default for both countries).

These steps should be repeated for each type of relevant tax: income, social, state, etc. The reader should refer to my August 2023 blog, “How Social Taxes Apply to Mobile Employees,” for a deeper discussion of social tax sourcing positions.

Many jurisdictions (in particular, US states) do not have specific sourcing regulations, in which case I recommend defaulting to the federal methodology used.

Special Considerations

Workdays or Calendar Days: Most jurisdictions refer to the use of workdays for sourcing calculations. However, it is commonly accepted practice to use calendar days where the employer has not tracked workdays.

Ordering of exercises: When stock options or SARS are partially exercised, the grant-to-vest methodology requires the identification of the tranches being exercised. To the best of my knowledge, there is no statutory guidance on this. However, it is commonly accepted practice to use a first vested, first exercised approach. This is also the approach commonly used by stock administration systems.

Nonemployees: Nonemployees might not be sourced in the same way as employees. Some jurisdictions require nonemployee income to be sourced based on the location of the service recipient (e.g., the company they are contracting for) instead of where the services are performed.

One major area for consideration is the sourcing of income for directors. Independent directors may be sourced to the headquarters location of the company on whose board they sit instead of the location where board meetings are held.

Conclusion

Determining the amount of income to report and/or withhold taxes for mobile employees is complex. The amounts depend on the jurisdictions concerned as well as any interjurisdictional agreements. Companies should consult with their advisers to determine the sourcing methodology to be used in each situation and document their positions for future consistency.

[1] See CFR § 1.861-4(b)(2)(ii)(F)

-

By Marlene ZobayanPartner

Rutlen Associates LLC