Innovative Ways to Attract, Retain & Incentivize Key Employees

May 29, 2024

Across all industries -- and companies of all sizes -- there has been a significant struggle to attract, retain and incentivize key executives in the current economy.

Talent is ripe, and there is a huge need for talent.

This also means there’s competition for talent.

So how can you attract, retain and incentivize key talent?

Equity incentive plans offer an excellent way to attract, retain and incentivize key talent.

Let’s face it. Increasing base salary is not going to cut it in today’s economic environment, nor is it sustainable for most companies.

There is a huge amount of flexibility with regard to equity incentive plan offerings. This includes both “real equity” and “phantom equity”.

What are the advantages of equity incentive plans?

For employers, equity incentive plans help attract, retain and incentivize key executives by providing additional benefit incentives and awards for performance and/or length of service.

Employers can offer different types of equity awards depending on the overall equity plan goals.

There is significant flexibility for employers in determining the plan parameters, vesting schedules, and awards criteria.

For employees, equity incentive plans offer an opportunity to earn additional benefits aside from a base salary. Employees have the ability to earn various equity awards, including stock options, stock appreciation rights and restricted stock grants.

The possibilities are largely endless, as long as the legal rules are complied with from a plan design and administration perspective.

What are the different types of equity incentives and related implications?

There are several types of real equity and phantom equity options.

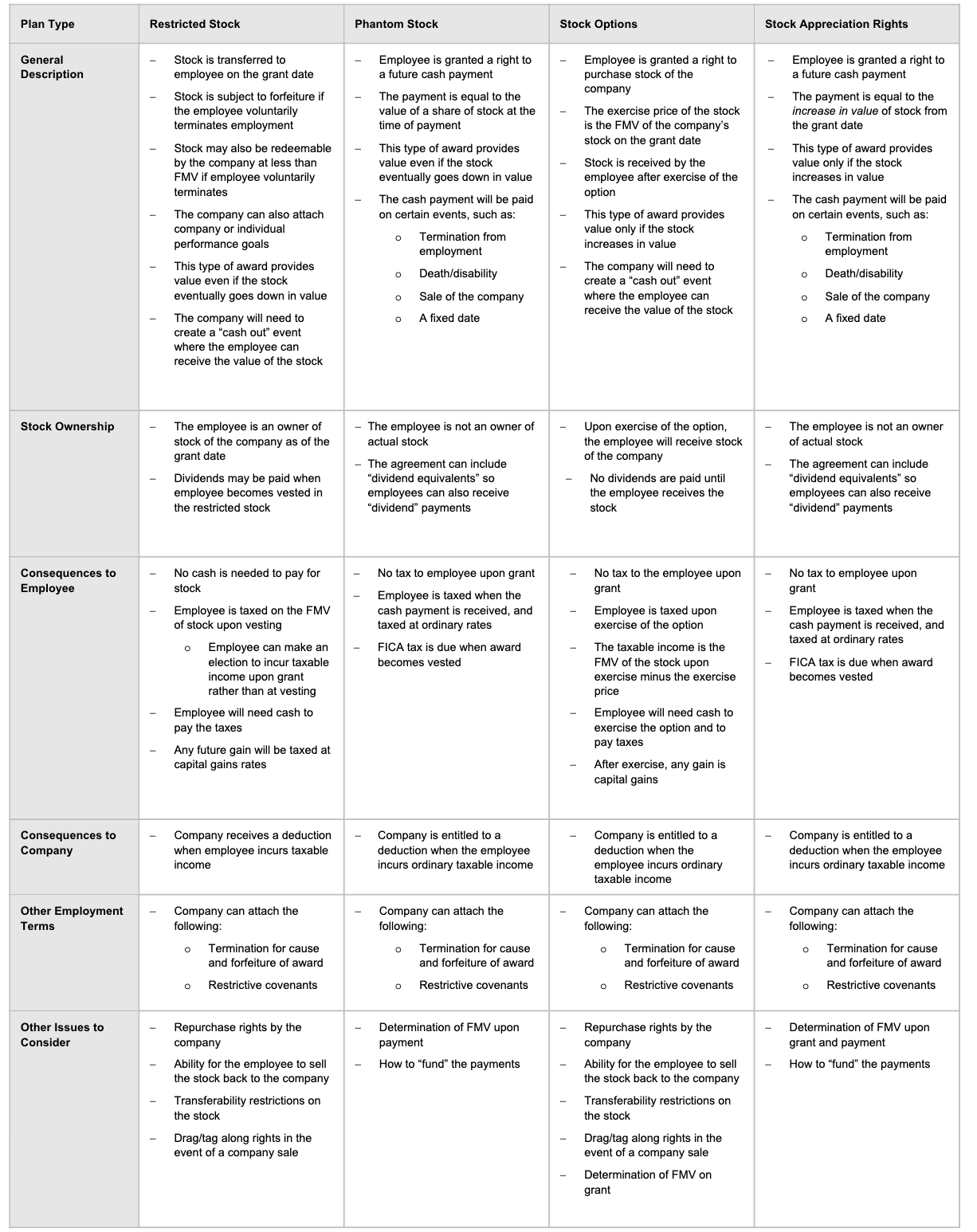

Below is a helpful chart that illustrates some of the commonly-used equity incentives as well as a direct link where you can download the chart.

Commonly-Used Equity Incentives Chart

What are the key considerations for employers when establishing an equity incentive plan?

When considering establishing an equity incentive plan, you need to consider your overall business goals, as well as potential risks.

These plans can be used to achieve business goals and protect against risks.

Many companies establish equity incentive plans that offer multiple equity incentive forms, such as restricted stock, phantom stock qualified and nonqualified stock options, and stock appreciation rights.

By working with an experienced employee benefits attorney, employers can implement and maintain customized equity incentive plans to meet their needs and the needs of their employees.

What is the bottom line?

Equity incentive plans are excellent employee benefit plan options with the flexibility to meet many types of business objectives and give employees a true sense of ownership, or having “skin in the game”. They offer a way to meet various business goals – as well as a way to mitigate business risks.

If you are considering offering equity or phantom equity to your key employees, you should discuss with your tax professional and employee benefits attorney to review the alternatives and get one or more plans established to best meet the needs of your business and your employees.

-

By Emily LangdonPartner

Fraser Stryker PC LLO