Managing Tax Withholding for Multinational ESPPs

September 11, 2024

Over 80% of employee stock purchase plans in the United States are tax-qualified. While this is a great benefit for US employees, tax qualification rarely extends to employees based outside the U.S.

Not surprisingly, the taxation of ESPPs, like other equity awards, varies by country, often leading to different tax obligations. In many countries, ESPPs are taxed similarly to nonqualified stock options, meaning participants may recognize income at the time of purchase. This can result in both a reporting and tax withholding requirement for employers.

Learn More!

There’s a lot to know about multinational tax withholding for ESPPs than I can cover in a blog. Check out the session “Taxation of Global ESPPs Demystified” at the 2024 NASPP Conference & Exhibition to discover all the ins and outs of this complicated topic and to hear how two companies handle their tax withholding programs.

Key Question: How Do Companies Handle Local Tax Withholding for ESPP Purchases?

Tax withholding on ESPP purchases presents several challenges. First, there are often no funds available at the time of purchase to cover the withholding. Second, determining the correct withholding rate can be difficult, as most countries do not have a flat rate. Lastly, participants may not fully understand why taxes are being withheld, which can lead to confusion.

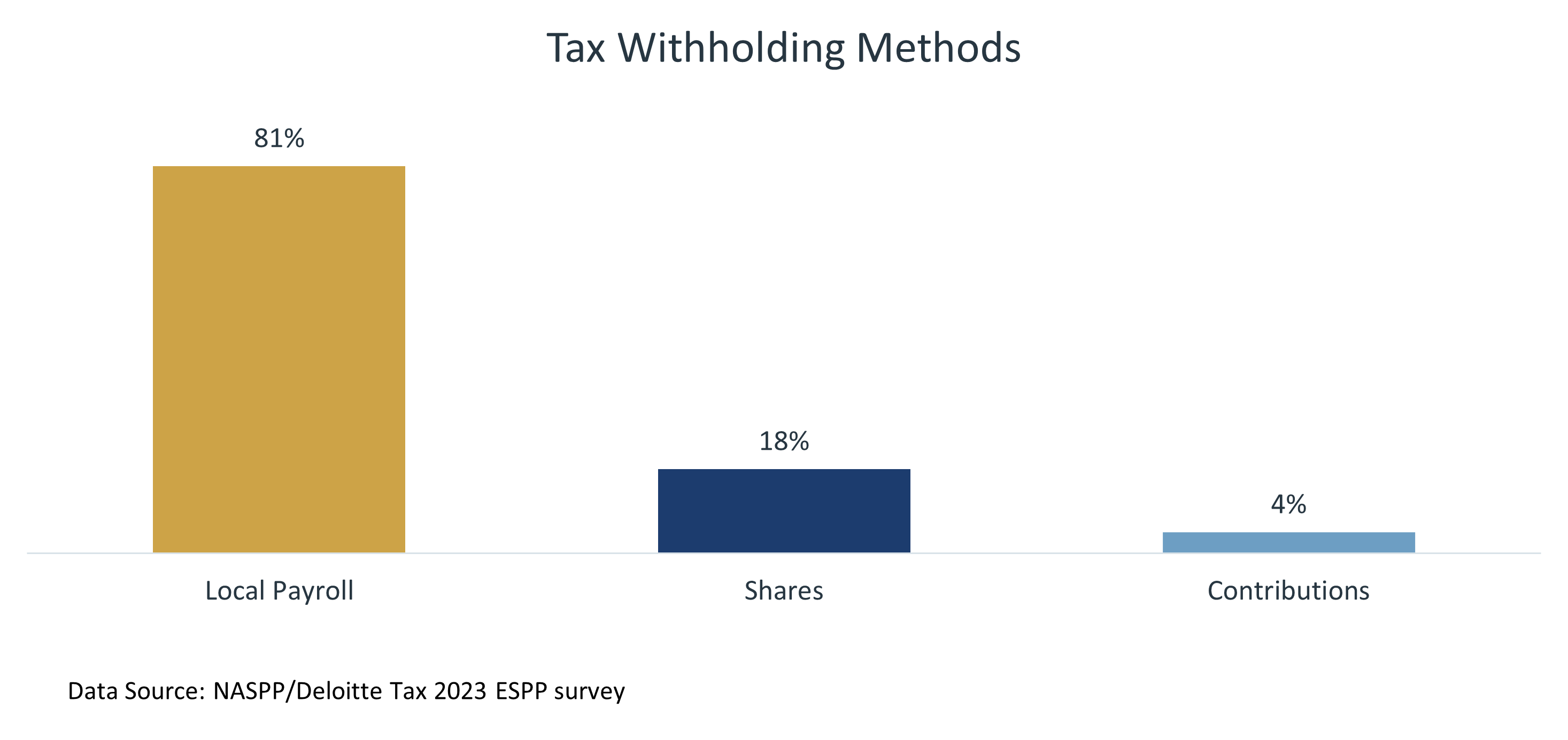

Companies typically choose from three main approaches to manage this:

- Rely on local payroll.

- Use shares to cover the withholding.

- Apply a portion of employee contributions to the withholding.

The following chart shows the prevalence of each of the above methods (note that some companies use multiple methods, so the percentages add up to more than 100%):

Approach 1: Relying on Local Payroll

This is overwhelmingly the solution of choice for most companies. Local payroll teams are well-versed in the appropriate tax rates and often have the ability to withhold taxes from employees’ wages. However, this requires close coordination with your local payroll teams and sufficient training for payroll staff to ensure they fulfill their obligations accurately and on time.

There are also several challenges with this approach:

- Reducing the size of employee paychecks could mean that employees do not have sufficient funds to cover their other financial obligations. Advance communication is critical to ensure that employees are prepared for this.

- Employees may not have sufficient wages to cover the withholding. In some cases, withholding may need to be spread over several pay periods.

- If employees are required to pay withholding taxes separately (e.g., by writing a check to the company), local payroll may have difficulty collecting these payments from employees. There may be situations where the payroll team is unable to collect the funds from employees, especially if employees are confused about why they have to pay these taxes.

Approach 2: Using Shares to Cover Taxes

This method involves either withholding a portion of the purchased shares or selling a sufficient number of shares to cover the tax obligation. This approach avoids the need for cash outlays from employees but comes with significant downsides.

Challenges include:

- Lower-paid employees purchasing only a small number of shares may be left with too few shares after taxes are withheld, which can reduce the plan benefit employees both realize and perceive and could undermine the company’s goals of encouraging stock ownership.

- Determining correct tax rates can be problematic. Local payrolls would have to supply the appropriate individual tax rates; this simply may not be feasible given the time constraints. Companies might be forced to resort to withholding at the maximum individual tax rate, with local payroll refunding any excess, which further reduces net shares employees acquire.

- If shares will be withheld to cover the taxes due, companies must maintain sufficient cash reserves to cover the tax deposits, which could be substantial, especially in countries with high tax rates.

In addition to the above challenges, selling shares to cover the taxes has its own set of special issues:

- The volume of shares sold may exceed market demand.

- Sales during closed trading windows may be restricted.

- Transaction fees further reduce the value participants receive.

- Compliance with Section 16 and Rule 144 for corporate insiders can add complexity.

Approach 3: Using Contributions to Cover Taxes

A portion of the participant’s ESPP contributions can be allocated toward the tax obligation. While this prevents the need for further cash outlay, it introduces several issues.

Challenges include:

- A circular calculation problem arises: as contributions are applied to tax withholding, the number of shares purchased decreases, which affects the tax calculation. This can create a continuous cycle of recalculation.

- Employees may end up receiving a refund for unused contributions, reducing the potential benefits of the ESPP.

- This approach can significantly affect employees’ purchasing power and may reduce their enthusiasm for the plan, undermining the company’s goal of promoting stock ownership.

Bonus—Approach 4: Think Outside the Box with a Company Match

Offering a match on contributions rather than a discounted purchase price can be an innovative and streamlined solution to tax withholding on a global ESPP. With this approach, the company matches a percentage of each employee’s contributions to the plan. [A contribution match is economically the same as a discount: a match of 17.6% equates to a discount of 15%.]

If the plan does not include a lookback, employees’ taxable income is generally equal to the match (although, as always, tax laws can vary by country). This allows the company to deduct the withholding taxes through payroll as each contribution is made to the plan. It is a genius way to simplify the process of tax withholding. And there are more great reasons to offer a match—check out my video ESPP Design: Match vs. Discount.

One caution here: it isn’t clear that a plan that includes a contribution match can be qualified under Section 423. But, as noted above, tax qualification in the United States does not extend overseas, so offering a nonqualified plan doesn’t disadvantage your non-US employees in any way. Assuming all non-US employees are employed by a corporate entity that is separate from the US parent, you could offer a nonqualified plan outside the United States and still have a qualified plan for US employees.

Or go completely outside the box and offer a nonqualified plan everywhere—here are ten reasons to go nonqual with your ESPP (and check out Emily Cervino’s guest blog on why qualified dispositions are overrated). For some great examples of a nonqualified ESPP, check out our podcast with Sandra Sussman on SAP’s plan or listen to Anabel Pichler describe Global Foundries’ plan during our webinar “2023 Results: Top ESPP Trends.”

Conclusion

Managing tax withholding for multinational ESPPs is complex, with no one-size-fits-all solution. Companies must carefully weigh the pros and cons of each approach while ensuring compliance with local tax regulations. Whether relying on local payroll, using shares, or applying contributions, effective communication with employees is key to minimizing confusion and maintaining engagement with the plan.

-

By Barbara BaksaExecutive Director

NASPP