Operational Efficiency in Equity Plans: Turning Chaos into Clarity

September 25, 2024

By improving operational efficiency, companies can reduce the time and resources needed to manage their equity compensation program, decrease costs, improve accuracy, and reduce risk.

To improve operational efficiency, companies can focus on automating processes wherever possible, tracking and reducing errors, ensuring compliance with regulations and accounting standards, and implementing a robust employee training and self-service portal.

Complex, Time-Consuming Administration

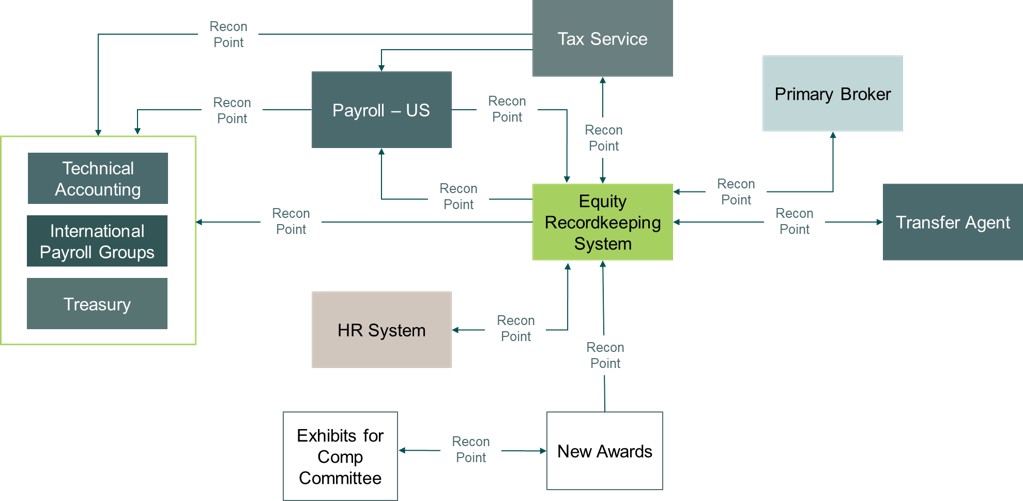

Each line represents a data exchange and therefore a risk of errors, such as inaccurate or incomplete records. Most equity administration teams dedicate valuable time to manually reconcile these data flows, which is a primary area for operational improvement. For example, reconciling transactions between the broker to payroll platforms is often manually performed in spreadsheets and takes significant time.

Below, we explore the importance of operational efficiency in equity compensation and provide suggested tips for improving it.

Importance of Operational Efficiency in Equity Compensation

Tips for Improving Operational Efficiency in Equity Compensation

Here are four tips for boosting efficiency.

Automate Processes Wherever Possible

Automation can reduce the time and resources needed to manage equity compensation. This includes automating grant approvals, tracking vesting schedules, and processing exercises and settlements. By automating these processes, companies can reduce the risk of errors and improve accuracy. Some examples where automation can be achieved include:

Spreadsheet scripting. Use macros and software code to reduce the number of manual steps.

Advanced scripting tools. Set up robotic process automation tools, such as Alteryx, UI Path, R, and Python, to perform recurring processes.

Vendor platform integration. Work closely with vendors such as the broker and payroll platforms to fully use functionality.

Purpose-built applications. Leverage an equity management software platform specifically designed to work within a company’s equity compensation processing environment to streamline end-to-end processes, reducing the time and resources required to manage the plan.

Focus on Identifying and Tracking Processing Errors

Interestingly, AI is now being used to identify new data quality errors that would not normally be detected by existing business rule functions. AI can find unusual data anomalies, like finding a needle in a haystack, and detect processing errors before they occur. AI-based efficiency gains in the equity world are real and powerful.

Improve Compliance With Regulations and Accounting Standards

Compliance is critical in equity compensation, and companies must know they’re following all relevant regulations and accounting standards. This includes properly approving equity grants, accurately tracking vesting schedules, and correctly processing exercises and settlements. By achieving compliance, companies can reduce the risk of errors and improve accuracy.

Implement Robust Employee Training and a Self-Service Portal

These companies often work with either their broker or internally to develop the self-service portal to allow employees to manage their equity compensation benefits themselves. Self-service portals are also seeing significant enhancements with the rapid increase in generative AI tools that allow the employees to ask plan information, especially for basic help desk support. This reduces lost time to call centers and unnecessary help desk escalations because the generative AI answers employee questions accurately and efficiently.

Next Steps

Ultimately, companies that are operationally efficient provide their employees with a valuable benefit that aligns their interests with those of the company and its shareholders.

Conduct an Equity Process Assessment

A well-formed assessment project will also prepare an executive report that presents a summary of challenges, the options for addressing the inefficiencies, and any planned return on investment as needed. Problem areas commonly exist in payroll, taxation, and the numerous system-to-system reconciliations, such as broker to payroll tax withholding, and are often a great place to start.

---------

-

By Matthew McKittrickPartner

Moss Adams