Planning for Equity on the Path to an IPO

January 16, 2025

Fourth quarter of 2023 was anticipated to be the revival of the IPO market, but uncertain financial markets, interest rates, and an upcoming election stalled this revival. Now, it is expected that 2025 will see an increase of IPO and M&A activity. The delay in IPO activity has created additional considerations for pay design and delivery.

Private companies preparing for a liquidity event are reviewing their compensation philosophies and overall corporate reward structures. Considerations include:

- Salary structure design

- Equity strategy development

- Job architecture and leveling development

- Employee value proposition

- Incentive pay design – including equity guidelines

- Pay equity analysis

In addition, pre-IPO companies need an understanding of institutional investors’ requirements, SEC compliance, and peer development, and to create a compensation transition strategy and educate the board of directors.

What If a Liquidity Event Isn’t on the Horizon?

Closely held companies and family-owned business understand they need equity opportunities to attract and retain talent. These awards are generally cash-settled opportunities tied to appreciation of the value of the company’s stock, and the payout is cash at vest, retirement, or when another condition is met. Phantom stock, stock appreciation rights (SARs) or cash-settled restricted stock units (RSUs) are most typical. These programs balance the controlling shareholders’ desire to limit actual equity awards to a few participants and to drive long-term appreciation opportunities. Awards that are equity-settled are generally subject to restrictions such that the company has a right of first refusal to repurchase the shares.

Equity Practices When a Liquidity Event Is Expected

Life science, biotech, and emerging technology companies that expect a future liquidity event (IPO and M&A) typically use equity awards to attract and retain talent from Day 1. Award opportunity is directly tied to companies’ business plans and future share appreciation. These companies design pay such that they offer competitive base salary and annual incentives. However, without a significant equity opportunity they will not be competitive. It is expected that these awards will lead to wealth accumulation opportunities for participants. The general design of these awards is:

- Opportunity value is a percentage of the company

- Grant is at date of hire

- Vesting is four years

- Vesting accelerates upon a change in control (CIC)

- Additional award opportunities arise in 3-5 years, based on business strategy

Stock Options Are Common for Companies on a Path to IPO

For most pre-IPO companies the preferred equity vehicle is stock options. Award opportunity and design are influenced by a number of competing factors:

- Candidates for some specialized roles have leverage in compensation negotiations and can demand above-market grants (for highly specialized roles such as AI expertise)

- For most other positions the employer defines the opportunity and harmonizes it across employee level and location

- Equity strategy is influenced by investors’ focus on dilution

- Equity grant differentiation (whether by award type or individual) is key to managing equity spend and employee expectations

As the IPO or other liquidity event becomes closer, equity professionals need to understand how award design will change. Public company design has significant differences including award opportunity, frequency of grants, vehicle type, and eligibility.

Key Considerations for Equity Plans as a Company Matures

- As companies mature, their approach to equity evolves

- Late-stage, high-valuation private companies may consider a transition to a public company approach prior to IPO

Award Size

Private Philosophy

- Established based on a target ownership percentage

- Measured cumulatively at a given point in time

Public Philosophy

- Equity grants are established based on a target dollar value delivered annually, converted to a number of options/shares based on the current stock price

New-Hire vs. Ongoing/Refresh

Private Philosophy

- Large new-hire grant

- Refresh grants delayed until IPO approaches, or 3 to 4 years after hire

- Refresh guidelines set anywhere from 25% to 35% of new-hire awards

Public Philosophy

- New-hire award typically 2x ongoing award size

- Most employees eligible for ongoing award after one year of service

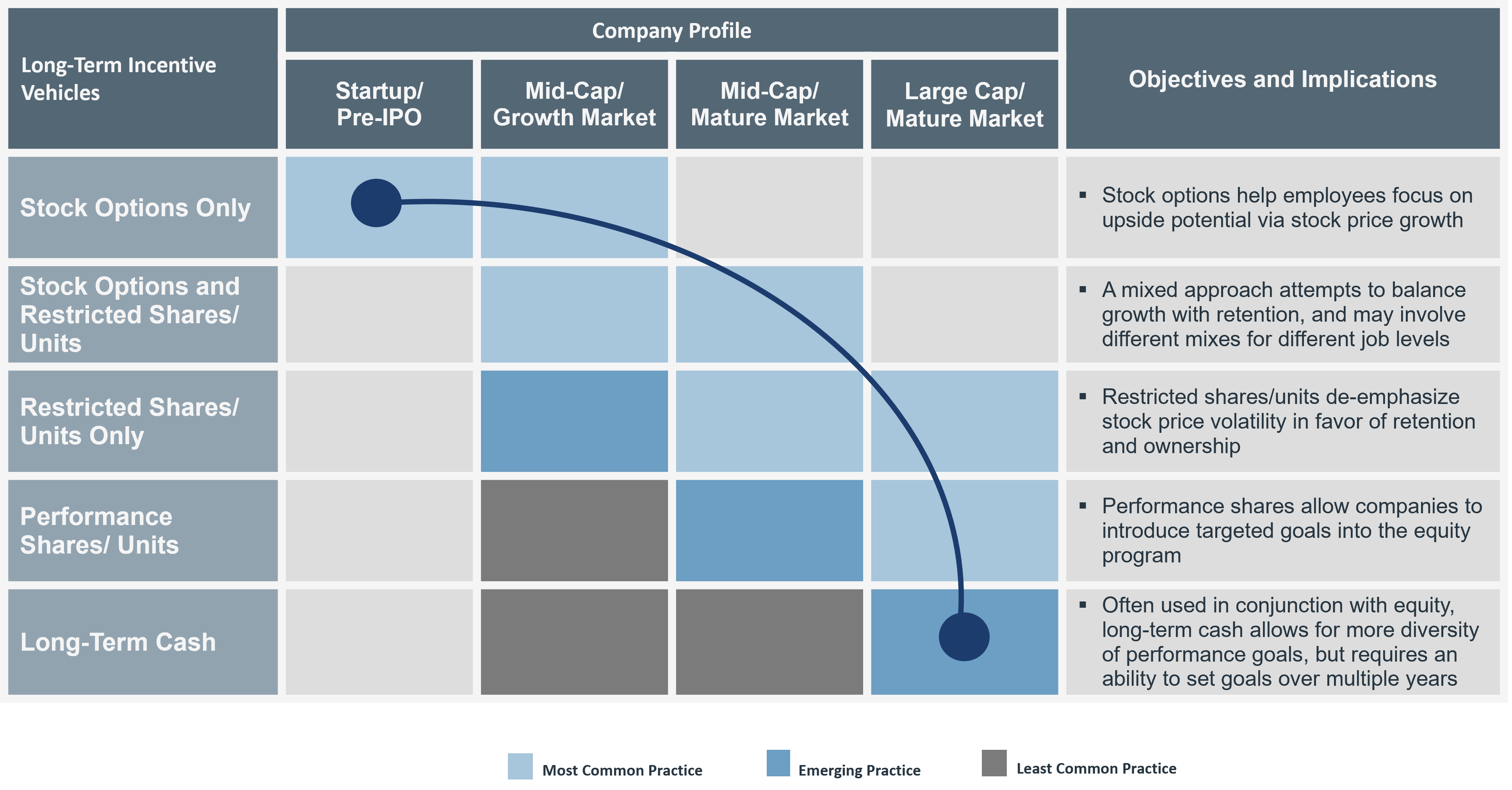

Vehicle Mix

Private Philosophy

- Stock options predominantly

Public Philosophy

- Mix of stock options and RSUs

- Emphasis towards RSUs with maturity over time

- Prevalent use of performance shares for executives

Participation

Private Philosophy

- New hires: nearly 100%

- Refresh awards: Targeted at key performers and those employees greater than 50% vested

Public Philosophy

- New hires: Participation decreases as company increases in size

- Ongoing awards: Broad eligibility is maintained, although awards targeted at top performers (40% to 60% of population receiving annually)

When Liquidity is Delayed

As noted, stock options are market-prevalent for pre-IPO companies. However, as the liquidity event is delayed, other awards should be considered. A number of equity design issues occur when an IPO is delayed:

- Share pool reserves run low, and continuing to grant stock options will further dilute the pool

- Initial awards are fully vested and top-off awards are limited because of the reduced share pool,

- Reduced share appreciation is not creating wealth opportunities for recent hires

As such, companies that are still private and planning for a future IPO begin to evolve their equity award philosophies to align their award design with more mature companies, understanding that accelerated share appreciation and an unlimited share pool reserve are no longer possible.

Another influence on equity design is the ability of participants to “cash out” while the company is still private. Many companies use a tender offer, an arrangement where shares are sold to outside investors. The prearranged trade at a fixed price provides liquidity for employees while allowing the company to further delay the IPO. To learn more about tender offers, check out the NASPP webinar “Private Companies: Understanding and Managing Tender Offers.” Although still private the company will begin to adopt “post-IPO” equity design concepts as noted above. Once the company does go public, significant changes to equity award vehicles and opportunities are expected.

-

By Derrick NeuhauserSenior Director

Aon Hewitt