Profits Interest Units Explained

October 16, 2024

In the world of equity compensation, different companies have different structures. A corporation typically issues options or shares. A partnership or LLC, on the other hand, might issue profits interest units (PIUs).

Like other forms of equity compensation, PIUs allow the holders (typically in exchange for services to the company as employee) to participate in the company’s future growth. That participation includes profits from operations as well as distributions and future appreciation in the asset values.1 Another similarity is that PIUs are intended to align employee interests with building value for the company and achieving its business goals.

Unlike other partnership units, PIUs don’t require an upfront capital contribution from the recipients. Payment to all units in the partnership follow a tiered waterfall, and these units fall junior to any other capital units which have an associated capital contribution.

Profits interests fall into two general categories:

Those that pay out based on participation in the company’s actual earnings

Those that pay out based on a portion of upside created in the partnership realized through future distributions and/or an exit event. Here, the units become a part of the company waterfall on liquidation

Some units may have both features, but in this discussion we’ll consider them distinctly.

Understanding the Value Received

In all cases, profits interests are granted, rather than sold to employees, with a $0 liquidation value on the date of issuance. In other words, if the company is sold on the date the units are granted, the interests would receive no value, akin to an option granted at-the-money. This is different from a capital interest where a recipient pays into the partnership to receive a unit and may obtain a return of value, even upon an immediate liquidation.

As we mentioned, there are two ways holders receive value—based on a company’s earnings or based on an increased in equity value. The first is like a bonus plan, whereas the second is classified as equity compensation.

Distributions to PIUs based on investor proceeds upon a future liquidity event resemble a call option on the company value. That’s because they receive no distributions until the required capital distributions are made to all other capital units (typically a reimbursement of contributed capital with a level of profit). Often, PIUs are subject to an additional higher threshold before they receive value, similar to performance shares and options. For example, they might be eligible to receive value only if the capital units receive double their initial investment. These hurdles result in a lower value to the holders.

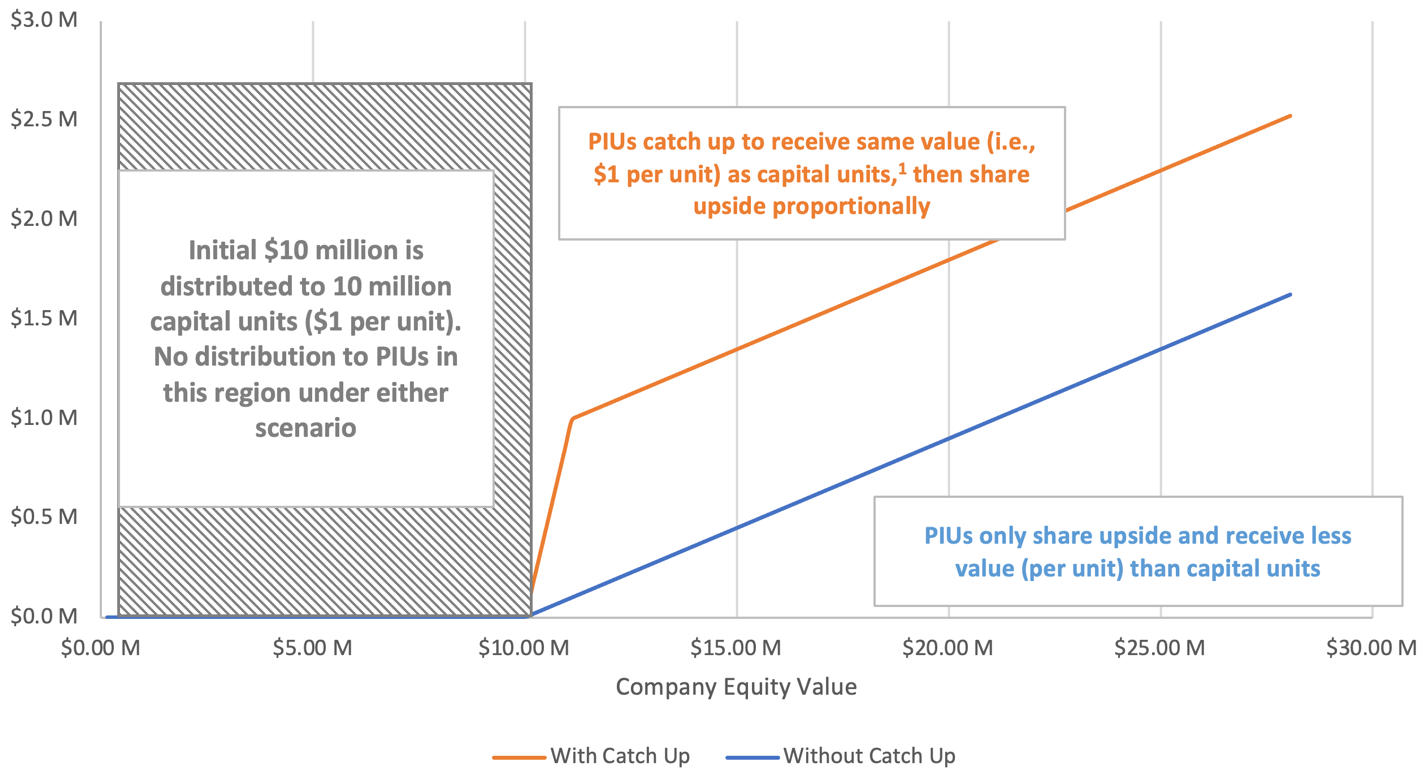

There are two payout profiles, both resembling other forms of equity compensation. To see how they pay out, suppose there’s a transaction above a threshold value of $10 million for the company. The PIU shown by the chart’s blue line is option-like, meaning it shares in value dollar for dollar with the capital interests. On the other hand, the PIU reflected in the orange line vests based on the threshold but results in a higher value unit when vested. These are similar to full value shares, and are incorporated by “catching up” the share value on vesting.

Payout Comparison for Profits Interest Units

1 The distribution threshold here is assumed to be $1 per unit. This may also be different than the per-unit capital contribution. For example, if a 2X return to the capital units is required for payout, then the distribution threshold would be $2 per unit. Similarly, the distribution threshold may also be lower than the per-unit capital contribution.

The valuation of these units takes these hurdles into account, typically by looking at the PIUs as a combination of call options on the full equity value of the company.

Accounting for PIUs

The relevant accounting standards and expense can differ substantially depending on the type of PIU. ASC 718 is applicable to the ones where profits are based on either growth of the entity’s overall market value or return of capital to the investors. Even if the vesting itself isn’t based on market value, but the distribution of proceeds is, the units would still be accounted for under ASC 718.

In other cases, the company’s equity value doesn’t determine remuneration for the PIUs, such as if the payout is based on the company’s accounting measures (such as operating profits or earnings). As an example, the pool of profits interest may receive 10% of the company’s net operating profits after tax, after the first $10 million. This is like an earnings-based compensation plan. The guidance from Accounting Standards Update (ASU) 2024-01 indicates the use of ASC 710.

Tax Implications for PIUs

To gain favorable tax treatment, PIUs are issued such that they have $0 liquidation value as of the issuance date. This means that, analogous to an at-the-money option, the value received by the PIU holder is zero if the company was sold as of the grant date. All value is based on future profit or upside value.

This allows for the use of a safe harbor under tax law. Under typical conditions, a PIU recipient can make an 83(b) election. An 83(b) election allows recipients to pay tax on a grant at the time of issuance, rather than at vesting, and set a cost basis accordingly. For PIUs, due to the lack of a liquidation value, the value at time of issuance for taxes is considered to be $0. Thus, no tax is due at grant, assuming the following conditions are met.

The profits interest should not relate to a substantially certain and predictable stream of income

The holder must not dispose of the profits interest within two years of receipt

The profits interest should not be a limited partnership interest in a “publicly traded partnership” within the meaning of section 7704(b) of the Internal Revenue Code

Further, assuming the holding period is longer than two years, the holder will typically be taxed on all proceeds at the lower capital gains rate.

It’s worth noting that if a PIU is held more than two years, the IRS guidance assumes that a deemed 83(b) election has been made, although most recipients still explicitly make these elections.

Tips for Successfully Implementing a Profits Interest Plan

For public companies, accounting for and administering an equity plan can be significantly aided by software systems geared toward their needs. However, at a private company, data may be very closely held. That raises the risk of asymmetries. To avoid information gaps, we help clients establish the necessary data templates and lines of communication for PIUs. Given the diversity of stakeholders involved, proper access controls are critical to program confidentiality. For more information, please reach out to the authors.

-

By Josh SchaefferManaging Director, Complex Securities Valuation Practice Leader

Equity Methods

-

By Nikhil GurujiSenior Consultant

Equity Methods